The Hungarian top league, NB I, has overtaken the Romanian as well – in terms of worth per team

In September, we were left off at the teams' combined worth in the OTP Bank Liga increasing the past year. According to Transfermarkt, the current value broke all previous records from 105 million to 133.59 million euros, or from 37.5 billion to 47. 529 billion forints. After the winter transfer window, which ended last Monday in Hungary, the estimated total value of the NB I squads is already at 146 million euros (52.14 billion forints), so the growth has continued. The question is, what does this mean, and what do the numbers mean in regional comparisons?

One of the main reasons, of course, is that we now have a team, thanks to Ferencváros, that's been in the European cups' group stage for years now and whose market perception is improving every year. On the one hand, because the value of footballers increases as the number of international cup matches and the number of players increase, and on the other hand because the club can sign higher and higher-ranked footballers. Fortune Bassey and Anderson Esiti of Nigeria, Carlos Auzqui of Argentina, and Brazil's Marquinhos are collectively valued at €10.3 million (Marquinhos is considered the most valuable player in NB I with €3.8 million). Thus, the value of Ferencváros reached 44.85 million euros from 40.25 million in six months, even though Myrto Uzuni of Albania, who signed for Granada in Spain, was reportedly sold by the club for around 4 million euros.

Looking at the entire NB I, we can say that we are intensively purchasing foreign players from national teams mainly from the neighboring countries and the top leagues of the Central and Eastern European region. There are foreign players, who were considered decisive footballers in their previous club and respective leagues, even in clubs that are fighting to not relegate – who were considered decisive footballers in their previous club and the respective leagues.

MOL Fehérvár has signed two players from Ukrainian champion Dynamo Kyiv, Bohdan Liedniev, and national team footballer Artem Shabanov, who both played in the Champions League group stage in the fall. 11-time Austrian national team footballer Peter Žulj played for Turkish topflight club Başakşehir (third in the league) in the fall. Honvéd also signed two players from the Ukrainian topflight, while Újpest signed Cameroonian national team defensive midfielder Petrus Boumal from Russia. Kisvárda strengthened the midfield with Rafal Makowski, who scored and assisted in the Polish topflight in the fall, while Mezőkövesd confirmed signing Vladislav Klimovich, who was bronze medalist Dinamo Minsk's key player and capped 19 times for Belarus.

Signing such foreign players of whom the majority is constantly playing well, especially during mid-season, seemed unbelievable ten years ago. It then lies ahead how these players perform in the long run, whether they really raise the standard of NB I, but their transfer will certainly improve the international reputation and market value of the Hungarian topflight. The latter is also contributed by the fact that Hungarian national team players, Tamás Kádár and Barnabás Bese, who have been playing abroad for years, returned to Újpest and Fehérvár, respectively.

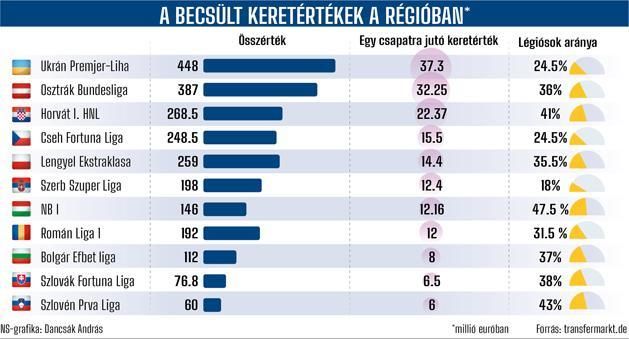

These processes have contributed to the fact that the estimated worth of NB I, compared to the leagues of the wider Central and Eastern European region (with whose teams domestic clubs would increasingly compete on the European stage and in the player market), is already ranked in the middle. The Ukrainian (37.3 million euros/team), Austrian (32.25), Croatian (22.37), Czech (15.5), Polish (14.4), and Serbian (12.4) top flights are still ahead of the Hungarian average (12.16) in terms of worth per team. However, Transfermarkt estimates that NB I is ahead of the Slovenian (6), Slovakian (6.5), Bulgarian (8), and now the Romanian (12) leagues in the region. Moreover, if the increase continues at the rate seen in the past year and a half, we will soon be able to catch up with/overtake the Serbian and Polish leagues.

It's another matter that the market situation of NB I could be improved if more than one team could reach the group stage on the international level and more and stronger Western European leagues could sign more players from us. Myrto Uzuni's transfer to La Liga or Vancsa Zalán's example, who has been playing football in Belgium since the summer, points in this direction. However, the real breakthrough in addition to the arrival of valuable foreigners would be if more and more young players from Hungary could play a decisive role in their club and increase their worth to the foreigners'. Now, each of the leagues in the region has proportionally fewer foreign players than Hungarian clubs. In fact, almost half of NB I's players (47.5 percent) are foreigners, and Hungary has the highest percentage of them among the countries studied.

Curtis pofonvágta az őt gyalázó szurkolót a lelátón

Az MU egyszer találta el a kaput, de egy szerencsés góllal így is nyert

Ez nem hiányzott: Szoboszlai Dominik még egy világsztár miatt aggódhat!

Milliárdokért árulja luxusotthonát az olimpiai bajnok

Villámgyors finomság – az 5 legjobb tejbegrízrecept

Orbán Viktor elutazik, ezen a helyen magyar kormányfő még nem járt

A szlovénokat legyőző Horvátország lesz a mieink negyeddöntős ellenfele kedden 18 órakor a kézi-vb-n

Szoboszlai szenzációs passzán ámul a világ - videó

A Chiefs újabb drámai meccsen nyert a Bills ellen – triplázás kapujában a Kansas City!

Chema Rodríguez: Óriási dolog, hogy sorozatban harmadszor ott vagyunk a nyolc között

Hétfői sportműsor: olasz, spanyol és angol futball, magyar futsal